snohomish property tax payment

425-262-2469 Personal Property. Taxes can be paid by eCheck debit or credit card using our Interactive Voice Response IVR system.

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

Snohomish WA 98291-1589 Utility Payments PO.

. Start Your Homeowner Search Today. Click for Instructions. Snohomish County collects on average 089 of a propertys.

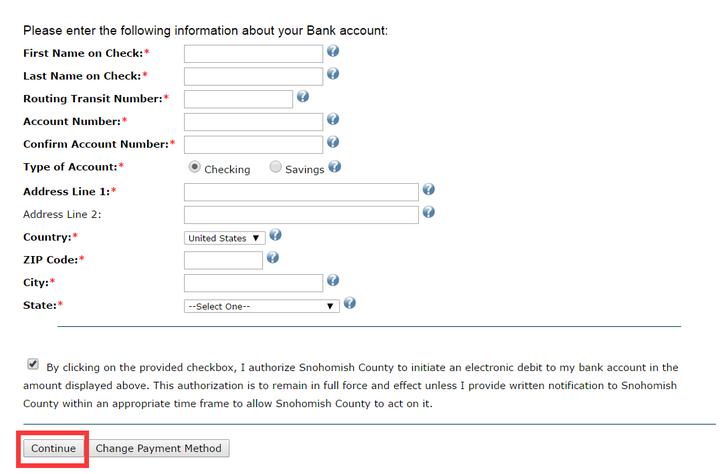

Make a one time payment below using your Parcel ID OR use the Create an account link to. The PUD offers a variety of convenient secure payment options online over the phone and in person. PO Box 1100 Everett WA 98206-1100.

If using a Discover Debit card it will be considered as a credit card payment please select the Credit Card option if using a Discover Debit Card. You must have an existing account before you can sign in with Google. Search Valuable Data On A Property.

Snohomish County Treasurer 425-388-3366. Ad Get In-Depth Property Tax Data In Minutes. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Help with Online Payments. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at. Doxo is the Simple Secure Way to Pay Your Bills.

To pay by phone youll need to call the Snohomish County Treasurers. Snohomish County Assessor 3000 Rockefeller Avenue Everett WA 98201 Phone. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600.

Find Information On Any Snohomish County Property. Prefer not to login. Such As Deeds Liens Property Tax More.

You will need a current statement from Snohomish County to. Taxes Tax Rates and Information For rate questions visit Washington State Department of Revenue or call 800-547-7706. A fee set by the vendor is charged for processing.

All with zero extra fees. Heres what you need to know about paying your Snohomish County property taxes by phone. To get help with online payments either email the treasurer with.

When summed up the property tax burden all. Free Case Review Begin Online. The Assessor and the Treasurer use the same software to record the value and.

Based On Circumstances You May Already Qualify For Tax Relief. Ad Find Snohomish County Online Property Taxes Info From 2022. Use the search to locate and pay your bill with Quickpay instead.

2022 Point Pay. Once you have registered for a Paystation account you can instantly access and manage your bills from Snohomish County. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average.

Ad Pay Your County of Snohomish Bill with doxo Today. Taxes Snohomish Tax Data. Pay Your Bill with doxo.

What is the property tax rate in Snohomish County. The county will post the payment to your account on the third business day following payment. Regional Transit Authority RTA No.

Pay for services online. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. Ad See If You Qualify For IRS Fresh Start Program.

Hecht Group Paying Your Snohomish County Property Taxes By Phone

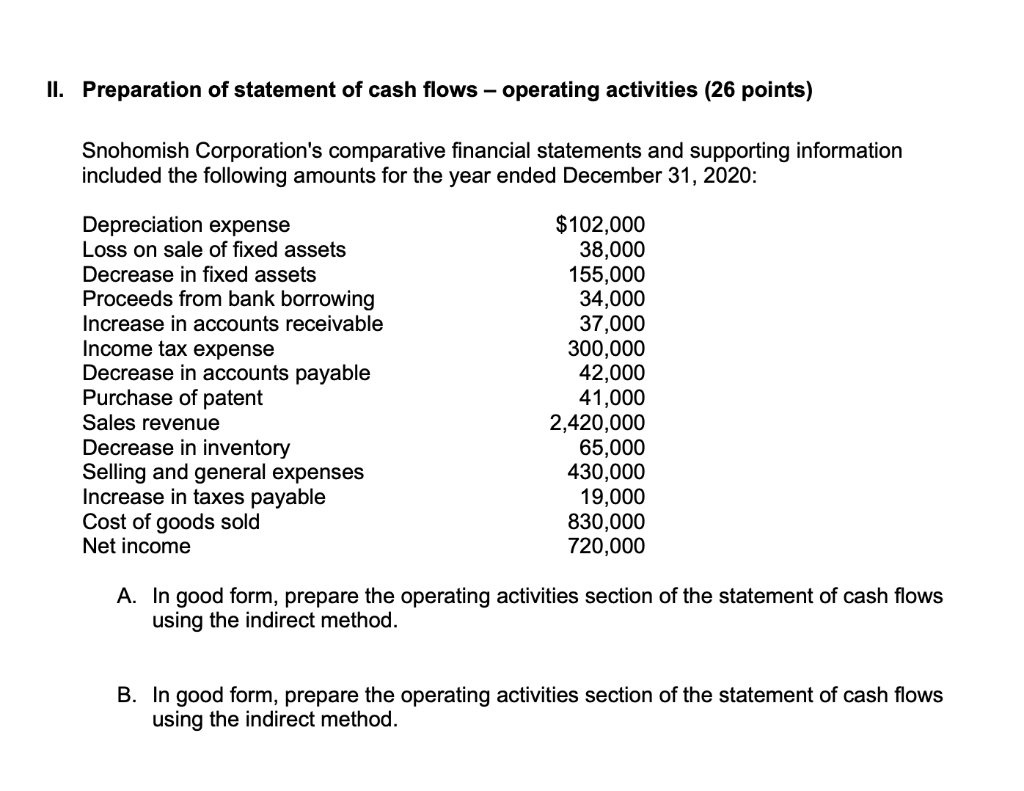

Solved Ii Preparation Of Statement Of Cash Flows Chegg Com

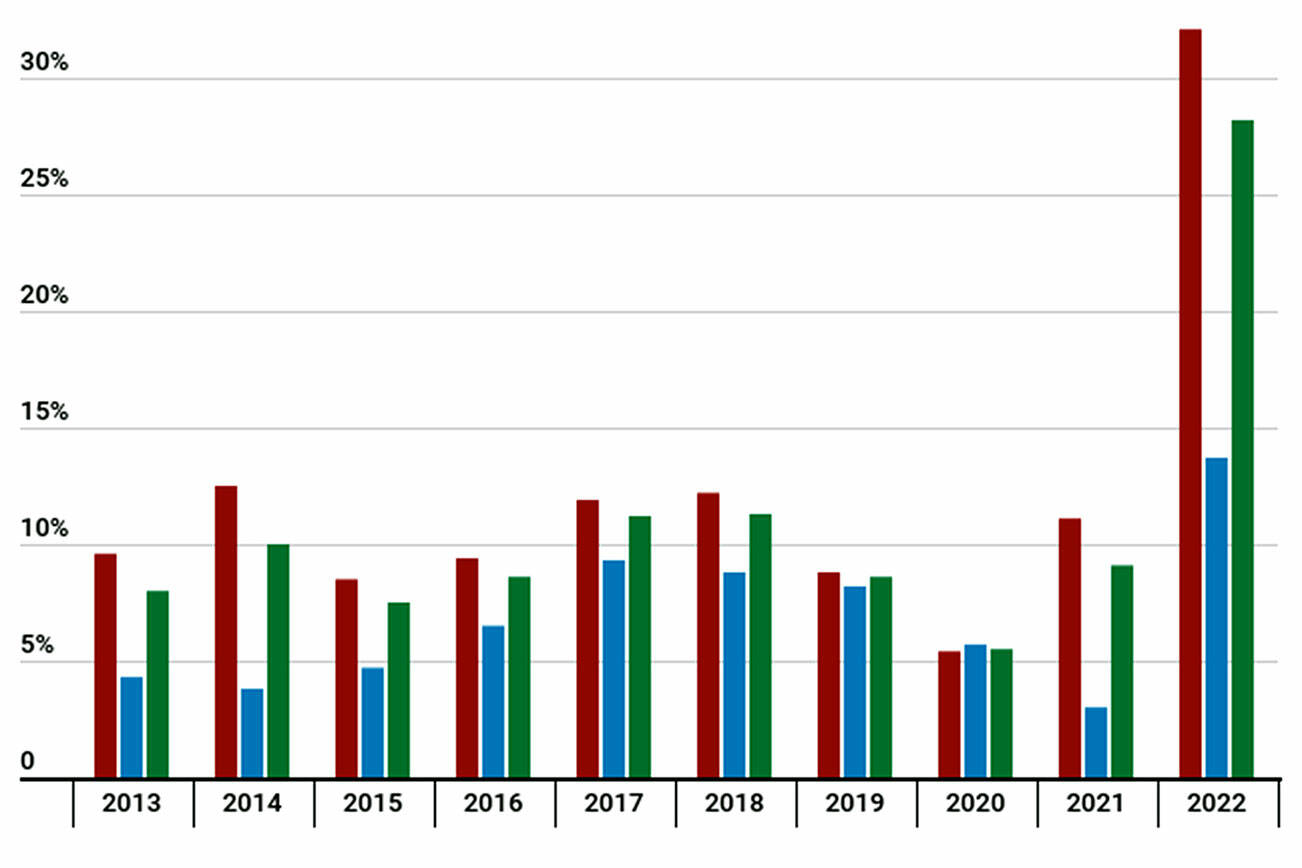

About Our District 2022 Snohomish School District Proposed Replacement Levies

Snohomish County News Events And Activities

Property Values Are On The Rise In Snohomish County Youtube

Property Values Soar 32 In Snohomish County Due To Hot Housing Market Heraldnet Com

Expert To Present Area Wide Property Tax Effects Of Snohomish S Proposal To Spur Development The Snohomish County Tribune Newspapers

Tax Payment Options Snohomish County Wa Official Website

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Snohomish County Property Values Soar As Housing Market Heats Up Mynorthwest Com

Snohomish County Wa Assessor Map Lookup

Snohomish County News Events And Activities

County Property Taxes Due By April 30 My Edmonds News

Snohomish County Property Values Increasing Rapidly King5 Com

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

1501 2nd St Snohomish Wa 98290 Mls 1965062 Redfin

Snohomish County Wa Property Data Real Estate Comps Statistics Reports

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com